Mastering chart patterns is not just a technical skill; it’s the lifeblood of crypto trading success. As traders dive into the volatile waters of digital currencies, they face an overwhelming sea of information, misinformation, and rapid fluctuations. Many find themselves struggling with indecision and loss, leading to frustration and diminished returns. However, by unlocking the secrets of chart patterns, you can gain a crucial edge in this highly competitive market. This article delves deep into the nuances of chart patterns, offering advanced insights and techniques that can transform your trading strategy.

Unlocking the Secrets of Chart Patterns in Crypto Trading

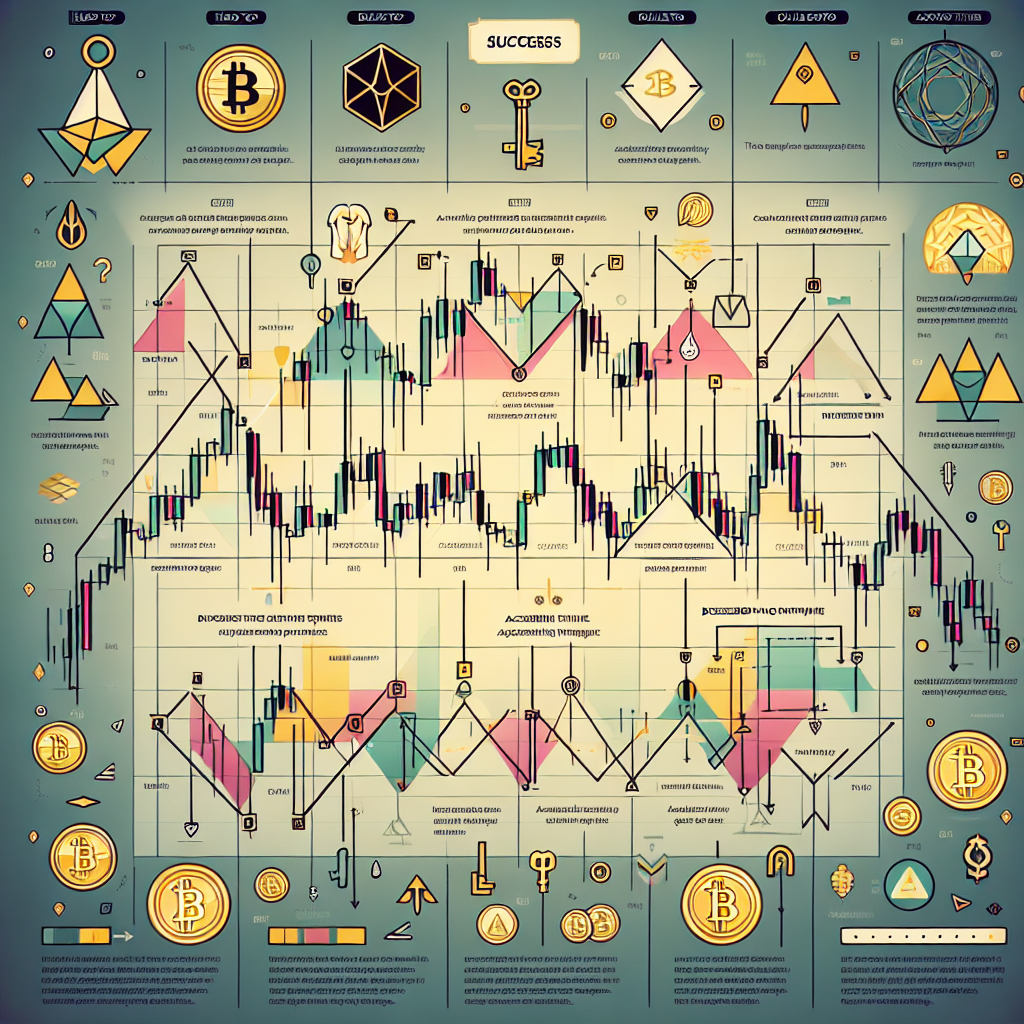

Understanding chart patterns is paramount for any trader venturing into the crypto space. These visual representations reveal collective market psychology, providing invaluable insights into potential price movements. For instance, classic patterns like head and shoulders or double tops are not merely artistic whims; they signify underlying market sentiment that can forecast future trends. By becoming adept at identifying and interpreting these patterns, you can position yourself advantageously for both bullish and bearish movements.

It’s essential to grasp that not all chart patterns are created equal. Each pattern carries its own weight and significance, and their effectiveness can vary based on the time frame and market conditions. Focusing solely on commonly discussed patterns may lead to missed opportunities. Instead, delve into lesser-known formations and nuances that can provide critical entry and exit points. Analyzing historical data and integrating these insights into your trading arsenal will elevate your proficiency, enabling you to make confident, informed decisions.

Moreover, mastering chart patterns is not limited to technical analysis alone. Integrating this knowledge with fundamental analysis and market news can enhance your predictive capabilities. For example, understanding how external events like regulatory changes or technological advancements impact price movements can provide context to the patterns you observe. This multifaceted approach to chart analysis fortifies your trading strategy, allowing you to navigate the complexities of the crypto market with a level of expertise that others may overlook.

Transform Your Trading Strategy with Proven Techniques

Transforming your trading strategy requires a blend of analytical prowess and practical execution. One effective technique involves setting clear parameters around specific chart patterns. For instance, when identifying a bullish flag pattern, define your entry point, stop-loss, and target price before executing trades. This level of preparation not only instills discipline but also minimizes the emotional turmoil that often accompanies trading decisions. By adhering to these predetermined rules, you can mitigate losses and maximize gains, fostering a more systematic trading environment.

In addition to setting parameters, utilizing tools such as moving averages and volume indicators alongside chart patterns can provide deeper insights. These complementary tools can validate patterns and reinforce your trading decisions. For example, if a breakout aligns with a significant increase in trading volume, the likelihood of a sustained trend improves dramatically. This combination of technical indicators and chart patterns empowers you to make high-confidence trades, allowing you to capitalize on market momentum effectively.

Another revolutionary tactic is the implementation of risk management strategies based on chart patterns. By analyzing the risk-to-reward ratio inherent in specific patterns, you can make informed decisions on position sizing and overall risk exposure. For example, understanding the width of a consolidation phase can help you calculate potential price targets and set stop-loss levels accordingly. This analytical approach transforms risk management from a mere afterthought into a calculated component of your trading strategy, significantly enhancing your overall success rate.

Mastering chart patterns in crypto trading is not merely a skill; it’s an essential element that can significantly impact your trading success. By unlocking these visual cues and integrating them into a holistic trading strategy, you set yourself apart from the masses who rely solely on gut feelings or trends. The insights and techniques discussed in this article are designed to elevate your trading game, providing you with practical tools to navigate the complexities of the crypto market effectively. As you continue to explore and refine your trading approach, remember that the mastery of chart patterns is an ongoing journey—one that promises substantial rewards for those who commit to its depths. Now is the time to seize these strategies and enhance your trading prowess.

Crypto Prices in Canada: Trends and Predictions for 2024Crypto Capital Venture: The Future of Investment UnveiledCrypto Prices in CAD: What Investors Must Know NowRelevant LinkRelevant LinkRelevant Link